SESSION 44

Author:

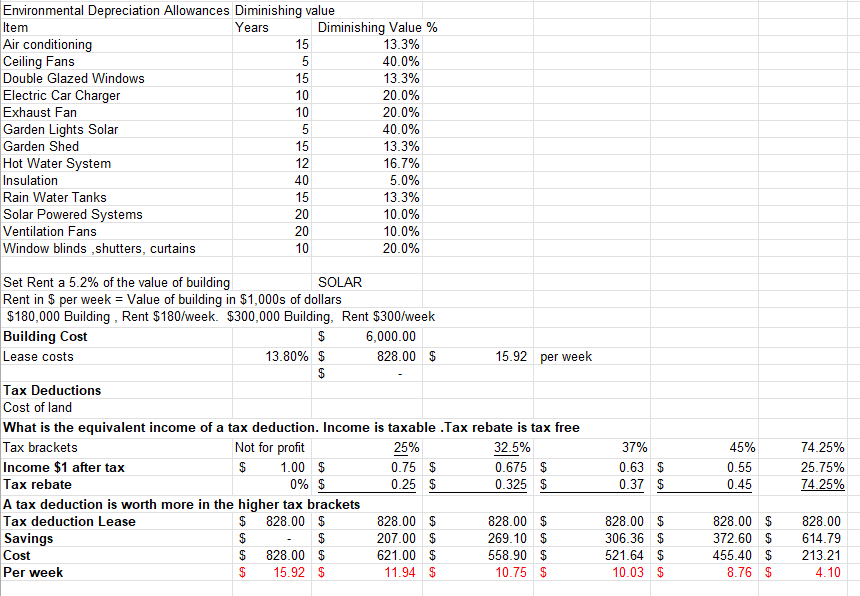

Session 37 Solar and Environmental Solutions

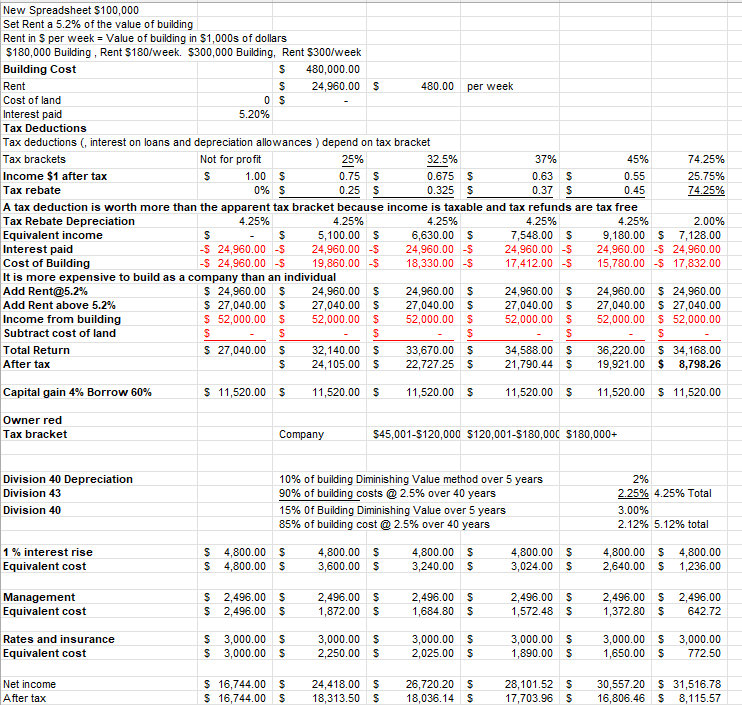

Sesssion 28 How to retire with a $480,000 property. Excell

We can analyse your specific situation very quickly with this spreadsheet, but it is not user friendly , so give us a call.

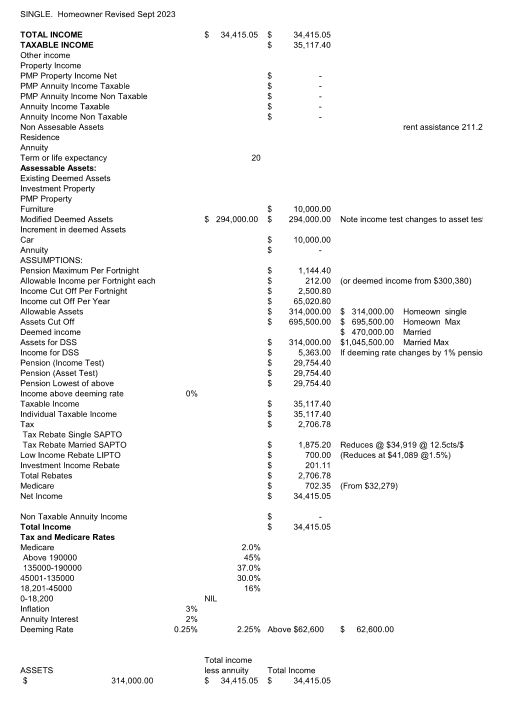

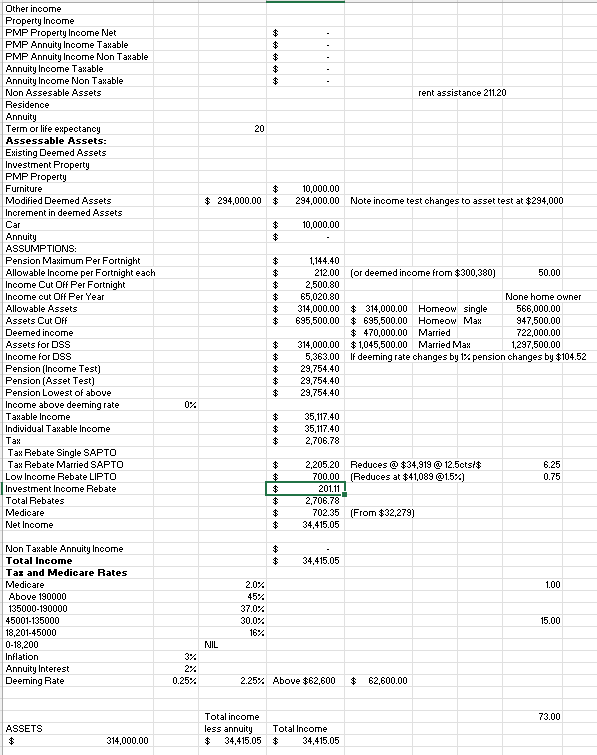

Session 13 Married Analysis. Excell

We can analyse your specific situation very quickly with this spreadsheet, but it is not user friendly , so give us a call.

SINGLE. Homeowner Revised Sept 2023

Session 12

We can analyse your specific situation very quickly with this spreadsheet, but it is not user friendly , so give us a call.

SINGLE. Homeowner Revised jan 2025

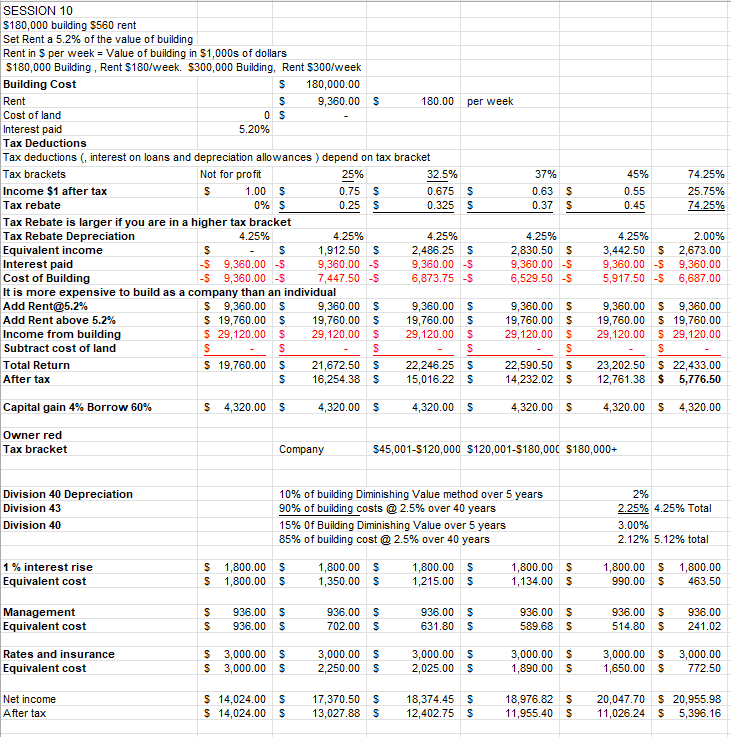

Session 10 Pensioner builds $180,000 Ancillary Dwelling. Exell

Introduction

As Peter Griep I am a director of Housing Affordability Tasmania Pty Ltd and also have been an investment adviser for over 20 years specialising in maximising pensions for retirees. See Session 41 for experience and expertise.

I am no longer an investment adviser and cannot give advice ( and charge you for it) but I can give information ( free of charge ) that will assist pensioners, in getting the most out of the Centrelink system. The government spends $220 Billion in pensions and welfare, and a large part of government’s strategy is designed to minimize pension. My aims are completely opposite and my information is designed to maximise pensions. I am retired now and you need a hobby in retirement. My hobby is beating Centrelink. I am lucky in that I know all the rules and they do not know everything about me (yet), so I am pretty confident that I can beat them legally using those rules.

The first 15 sessions are for pensioners only and if you are younger than 60 this is not for you unless you want to plan for the future or make your parents more comfortable.

There is a total of 41 sessions.

Session 16 is the Housing Affordability Trust (HAT) which is my unique solution to solve the Affordable Housing and Rental Crisis in Australia. I have not been able to get any support from governments or treasury and this series of sessions is designed to shame governments into action.

There is no way that Governments will solve the crisis with their current strategies and a radical change has to occur.

Session 16 at this stage is confidential.

HAT is designed to be not-for-profit and my biggest fear is that my unique strategy falls in the hands of Institutional Investors and the Price Waterhouses of this world which will completely destroy the aims of the strategy.

If anybody in the government is serious about wanting to solve the Housing and Rental Crisis they can contact me and I will disclose full and explicit details.

Sessions 17 to 38 give general comments on Finance , Affordable Housing and suggestions how to improve the Community Housing Sector.

In Session 38 the conclusion is that The Housing Affordability Trust is the only solution for government to solve all problems.

When will we get action!

Sessions

- Pensioners pay 74.25% in tax

- Shares or Property

- Pensioner Loan Scheme and Borrowings

- $60,000 Free car

- Compound Interest

- Pension Maximiser Plan (PMP)

- Death . A Personal Experience

- Restore Single Pension to Married Pension PMP

- Fact Sheet. Pensions .

- Pensioner builds $180,000 Ancillary Dwelling. Exell

- Pension Income Test

- Single Analysis. Excell

- Married Analysis. Excell

- Retirement Living Options

- Donations to Charity

- HOUSING AFFORDABILITY TRUST

- APRA

- Safe as a Bank ?. Is borrowing good or bad

- Free of Debt. Get rid of your housing loan.

- Never use your own money

- What is the Government doing to solve the Affordable Housing Crisis

- Australian Housing Urban Research Institute.

- Dear Minister

- ABC

- How to solve the Housing and rental Crisis

- Granny Flat

- How to retire within a year

- How to retire with a $480,000 property. Excell

- The Positive Gearing Plan. Free of Debt. 29A Excell

- Rent to Own

- Compare Community Housing Providers

- Do Community Housing Providers use the correct structure

- Government subsidies for Housing

- Housing Choice Proposal

- The Great Australian Dream

- How much can you borrow

- Solar and Environmental Solutions

- Withdrawing money from Super

- Conclusions

- Castle II

- Experience and Expertise

Regards,

Peter Griep

Session 1 Pensioners paying 73% Tax

This is Session 1

Pensioners paying 73% in tax

Give pensioners a fair go.

Approximately 16 % of Australians or 4.2 million people are over age 65 and this will increase to 10 million in 50 years time.

62% of these people are on a full or part pension. Of the people on a part pension 2/3rd is affected by the income test and 1rd by the Asset Test

Assets of this group of people are approximately $2,000,000,000,000 ( 2 thousand billion)

The majority of pensioners are affected under the income test so let us discuss this first.

Retirees on a part pension are treated very unfairly. They are by far the highest taxed entities by a country mile.

If you are earning more than $106 per week ($212 per fortnight) you become affected under the income test.

The “earnings” include the deemed amount in your superannuation fund or allocated pension.

The average balance in super at age 65 is $414,380 for men and $370,042 for women.

If you have $301,000 in super it is deemed at $212per fortnight and you are affected under the income test. The average pensioner is or will be affected under the income test or asset test.

The deeming rate after $62,600 is 2.25% which is very generous of the government.

I am actually very surprised that Centrelink has not matched the deeming rate to the Reserve Bank interest rate. If they do, the allowable super balance will reduce by $129,000 and your single pension will reduce by $371

A single retiree on an combined pension/income of say $45,000 will pay the following “tax”

For every dollar earned:

Loss of pension for every dollar earned in excess $204 per fortnight 50.00 cents

Loss Pensioner tax rebate SAPTO .½ of 12.5cts (starts at $34,919) 6.25 cents

Loss of Low income rebate LIT, ½ of 1.5 cts ( starts at $41,089) 0.75 cents

Tax ½ of 30% ( income $45,000 – $135,000) 15.00 cents

Medicare levy ½ of 2% (starts at $33,738) 1.00 cents

Total 73.00 cents

How unfair is that !

How can we reduce this “tax” ?

The first strategy is to change income to capital gain

Centrelink and the Taxation Dept have different rules. There is for instance no negative gearing for Centrelink ( losses cannot be offset against other income). Building allowances on property (Division 43) are not allowed but Centrelink will still allow depreciation for plant and equipment (Division 40) . Taxation department still allows both types of depreciation.

There is however one Centrelink concession left for retirees and that is Capital Gains . This means that a dollar of Capital Gains is worth a lot of money to a retiree.

Capital Gains is not regarded as income for Centrelink.

It is regarded as an asset but this will normally not affect the pension.

This makes property a very good investment for retirees on a part pension.

Using the example above , a dollar of Capital Gain is worth the following,

Pay Capital Gain after 1 year @ ½ x 30 cents = 15 cents

Therefore a retiree will have 27 cents left for every dollar earned but 85 cents left for every dollar of Capital Gain after paying Capital Gains Tax. This is a 315% increase

Or in other words; $1 Capital Gain is the equivalent of $3.15 of normal income

The Work Bonus

The government has relaxed the rules to allow pensioners to earn more money without affecting their pension under the Income Test. Previously pensioners had to be employed to qualify for the Work Bonus but now they can be Self Employed as long as there is Active Participation. Passive participation like income from investments or dividends from a company is not allowed.

A pensioner ( married pensioner each) can earn an extra $300 FN on top of $212/FN.

They can start with a balance of $7,800 per year , now increased to $11,800. Each fortnightly payment reduces the balance until exhausted. The balance is restored each year to $7,800 or possibly $11,800.

This Work Bonus can be a very useful tool for pensioners affected under the asset test that want to retain a part time job.

The second strategy is to create depreciation allowance as every dollar of depreciation equals $3.88 of ordinary income.

These strategies will be discussed in Session 6

Session 2 Shares or Property

SHARES OR PROPERTY

SESSION 2

In session 6 we will see that pensioners affected under the income test should look for capital gain as $1 in capital gain is worth $3.15 of ordinary income and that $1of depreciation is $3.88 of ordinary income. (see below)

Depreciation is primarily available for property which brings us to the question whether property is a good investment and particularly whether it is a good investment for pensioners.

The good old question of property against shares

Shares Growth 7% Income 4%

Property Growth 7% Income 4%

Depreciation 4.25% of building 5 years

There is very little difference in Capital Gain and income of shares and property in the long term apart from the fact that shares could be volatile and property is more stable.

If the property is an existing property the question is still unresolved.

There is a consideration to be taken into account with property if we split up property in land and buildings. Capital growth for land in the future will be greater than capital growth for buildings.

A standard clause in a Development Application (DA) is that the developer is responsible for any upgrade of infrastructure ( roads, sewer, stormwater and water). Most infrastructure in capital cities has reached it’s capacity and existing sewer and stormwater pipes will have to be increased.

Any new road reserve under Town Planning rules must be 17.5m wide, footpaths must be 1.5m wide and regional areas have the same strict demands as capital cities areas.

All this will result that property development becomes very expensive and the developer must pass this on to the public. This will also increase the value of existing property.

It is therefore likely that land will have a greater Capital Gain in the future.

Some argue that shares are liquid and property is not. This is not true because if you need money you can always borrow it with the property as security.

I was in a seminar together with 500 other advisers and a presentation of “Property against Shares” was given.

Lots of jargon, graphs , history but in the end it boiled down to the fact that the presenter considered income and capital of both investment but then finally compared the Accumulation Index of Shares (Capital Growth + dividends re-invested) with Capital Gain of property without the rent being re-invested.

And low and behold shares came out ahead.

Not one of the 500 advisers in the room stood up and said

“you are comparing apples with bananas and your argument is absolute rubbish”.

Investment advisers have a very vested interest. When you recommend a share-trust to your client you get a commission of 5%. If you recommend residential property you get nothing. Investment advisers use property trusts which are mostly commercial property.

Most investment adviser are controlled by a bank or financial institution. They can only pick from a recommended list and I have never seen a list of recommendations that includes residential property.

Most investment advisers will recommend a diversified portfolio but they argue that the client already owns their residence so why do we need further property.

So, shares and established property are probably 50/50 but new property is a different kettle of fish and new property is superior because of depreciation allowances.

There are 2 types of depreciation and the following is very rough and you should always get a Quantity Surveyor’s Report to prepare a proper depreciation schedule. Depreciation can be divided in Division 40 and Division 43.

Division 40

This is carpet , air conditioners etc which roughly amounts to 10% of the building. Depreciation is over a short period using the diminishing value method, say 5 years. This means that for the first 5 years 2% of the building cost can be used as depreciation.

Division 43

For the remaining 90% of the building. This is depreciated over a 40 years or 2.25% of the building cost.

So for new buildings for the first 5 year there is a tax deduction of 4.25%

Sell the building after 5 years or carry out Division 40 renovations and increase the rent

We are interested whether Shares or Property are a good investment for pensioners

Share Investment

Centrelink assesses shares under the income and asset test.

Under the asset test, shares are an asset. If registered on the stockmarket the value and number of shares has to be declared to Centrelink after which they will monitor the shares. Any fluctuation in share prices will automatically result in variations in your pension.

Under the income test, the actual income from shares is ignored . Instead the income from shares is deemed under Centrelink’s deeming rules.

Franked dividends and franking credits are ignored by Centrelink but are taking into account by the ATO.

Tax rules and Centrelink rules are different and franked dividends and Franking Credits may be beneficial to Self funded Retirees as they will reduce tax .

Centrelink still monitors the value of the shares and the deemed income from the shares may vary and therefore also affect your income under the income test.

Property Investment

Centrelink and the Taxation Dept have different rules. There is for instance no negative gearing for Centrelink ( losses cannot be offset against other income). Building allowances on property (Division 43) are not allowed but Centrelink will still allow depreciation for plant and equipment (Division 40) . Taxation department still allows both types of depreciation.

There is however one Centrelink concession left for retirees and that is Capital Gains . This means that a dollar of Capital Gains is worth a lot of money to a retiree.

Capital Gains is not regarded as income for Centrelink.

It is regarded as an asset but this will normally not affect the pension.

This makes property a very good investment for retirees on a part pension affected under the income test

Using the example above , a dollar of Capital Gain is worth the following,

Pay Capital Gain after 1 year @ ½ x 30 cents = 15 cents

Therefore a retiree will have 27 cents left for every dollar earned but 85 cents left for every dollar of Capital Gain after paying Capital Gains Tax.

This is a 315% increase

Or in other words;

$1 Capital Gain is the equivalent of $3.15 of normal income

The second strategy is to create depreciation allowance as every dollar of depreciation equals $3.88 of ordinary income.

These strategies will be discussed in Session 6

In summary

Long term income and capital gain in shares and property are roughly equal.

Under the asset test there is very little difference between shares or property. Shares have advantages if franking credits are used but property has the advantage of depreciation allowances.

Under the income test it may be beneficial using our strategies to change property income to capital gain or borrow money against investment property to invest in shares.

In both cases borrowing money will enhance the performance of the investments

In further sessions we will show that if you invest in property you should borrow against that property to invest shares.

Disclaimer

I have a vested interest in property being a director of a property development company building affordable rental accommodation for pensioners

Session 3 Pension Loan Scheme Borrowing for Pensioners

Is borrowing safe for pensioners ?

Which business borrows the most ?

Banks

If you want to set up a bank you need some money to start the business.

It is called the Capital Adequacy Ratio. In Australia it is 8% which means you need 8% in funds before you can borrow 92% from the public. The borrowing is in the form of fixed deposits and money in customer’s bank accounts.

In financial terms the Loan to Valuation Ratio (LVR) is 92%

Imagine that you want to set up a business similar to a bank and you go to your bank and say:

I have $8,000 in the bank and want to borrow $92,000

What are you going to do with the money ?

I am going to lend to other people and charge 2% more than what you are charging me

Do you have any security like property or so ?

I have $8,000

Do you think the bank will approve the loan

Not very likely but that is exactly what banks do

They put up a limited amount of money and then borrow the rest from you

Are the banks safe?

If 8% of the people want their term deposits back, the bank is bankrupt.

But the government stepped in and said we must subsidise this dangerous business and guarantee some of the funds. We do not want banks to go bankrupt because that is bad for the economy , so let’s subsidise them so they can make more profits.

Any profits the banks make is multiplied 12 ½ times. So if the bank makes 1% profit they actually make 12 ½% profit on their own money.

A normal margin between deposit and lending rates is 2% so if you put your money in a term deposit or bank account the bank makes 25% on your money and you are lucky if you get 5% ( or nothing in your trading account)

Profitable business ?. I think so

So in general, borrowing is a very good investment strategy.

Indeed if you borrow money for an investment and you are certain that the return of the investment is higher than the interest on the loan , it is an absolute win situation.

Borrowing also beats inflation as you are paying back a loan in deflated money.

Who can borrow?

The bank will lend you 30% of your income and 80% of rental income provided that you have sufficient security ( property)

You must have a job and regular income like a public servant or doctor otherwise the bank does not want to know you.

Small business will have all sorts of problems of borrowing money from a bank and if the bank approves a loan they will charge you 2% more or 10% more if your business income is not 100% sure.

It does not matter what your income is. Poor people can still make money. Whether you earn $25 per hour or $150 per hour as an engineer, if the cleaner borrows money for an investment in the long run they will always outperform the engineer that does not borrow.

Compound Interest ( see session 5) will do the trick

CAN PENSIONERS BORROW ?

The bank does not want to know you.

We do not take into account your pension income

You are too old.

Goodbye. Before you go, do you have any money to invest with us ?

Fortunately a pensioner can borrow from the Government. It is called the Home Equity Access Scheme ( formerly Pension Loan Scheme)

You can borrow 150% of the pension less the pension you receive so that a person on a full pension can borrow 50% or $572FN for a single pensioner and $862.60FN for a married couple. (Even more when you get rent assistance)

The interest on the loan is 3.95% which is very generous of the government as it is lower than the Reserve Bank rate (4.1%) or Government Bonds (4.4%)

What is more, you do not have to pay the interest until you die or sell the property you have used as security. You qualify if you are 65 or older ( 60 if you are with Veterans Affairs) and if you qualify if you are on a full or part pension and even if you are a self funded retiree. In the latter case you can borrow 150% of the pension or $2,587.80FN for a married couple.

Should you borrow

Hell Yes !

We have seen that if your investment has a return higher than the interest charged you should do so. So you can borrow at 3.95% to buy 100% guaranteed Government Bonds at 4.4% and laugh all the way to the bank. If you buy bank shares you make a lot more money.

But you can also borrow for medical treatment, holiday or just supplement living costs.

Your total borrowings are about ½ of the value of the property and the loan stops when you have reached that point. If you are young (65) you can borrow a bit less than when you are older.

There are a number of strategies whether you are on a full pension, affected under the income test ( Sessions 1, and 6) or under the asset test (Session 4) In the latter case we will show you how you can get a free electric car without any cost to you