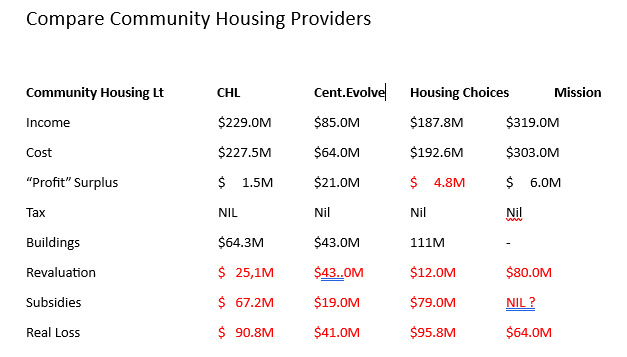

Note that these figures , except for CHL, are from the 2022 annual report.

The figures for CHL are also suspect as there is an obvious $10M mistake in the audited accounts for 2023

All Community Housing Providers are using Revaluation of their properties as a tool to make their Balance Sheet look better in order to borrow more money. This is only paper income and does not affect their real cashflow.

It is clear from the Annual reports that without subsidies the Community Housing providers struggle to survive. The important conclusion however is that all of the providers are not paying tax which of course, as not-for profit organisations, they should not.

A Community Housing provider should not build houses . The more tax you pay the more profitable it becomes to invest in houses.

If a person in the 37cts or 45 cts tax bracket builds a house they will build that house at very little cost to themselves if they borrow 100% of the value of the house.

Even pensioners can invest in housing profitably if they are affected under the income test.

If the pensioner borrows 100% of the property and If the interest on the loan is the same as the income from the rent they will still have a tax deduction of 2% of the value of the property which is $4,800 on a $240,000 property.

The average superannuation balance for males is $330,000 . This is deemed by Centrelink.

A balance of $270,000 will be deemed at $102 per week and now the pensioner is affected under the income test. Such pensioner pays 74.25% in tax ( See session 1). Therefore a $4,800 tax deduction is the equivalent of a $3,564 refund.

The average pensioner therefore could invest in housing. But rental income , after allowing for depreciation allowances and interest paid is not good income. It does not hurt pensioners much if they provide subsidised rents to the Community Housing Providers and help to solve the housing crisis.

Community Housing Providers should not build houses or buy houses whatever subsidies the government will give them . They should lease houses from high tax paying entities like doctors and pilots or even pensioners. Or lease properties from companies that “Build to Rent”